2013 Gold Price Forecast: Expect Gold to Deliver Another Record-Setting Year

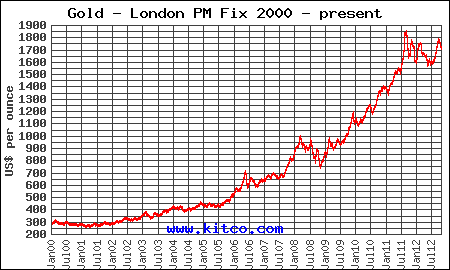

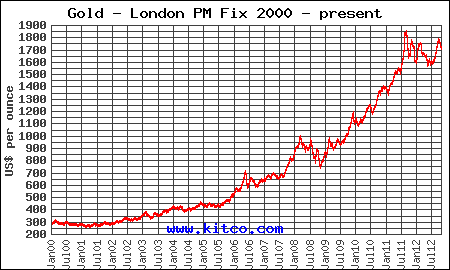

[Editor's Note: As you can see from the chart, gold

has been on an 11-year tear. But according to Peter, that's just the

beginning. In today's 2013 forecast Peter outlines the five forces that

will push gold to new all-time highs.]

- Share

No two bull markets are ever the same, and gold is no exception.

During the last secular gold bull market in the 1970s, gold rose from $35 in 1968 all the way to $200 by late 1974.

Then the unthinkable happened. Between late 1974 and mid-1976, gold prices were cut in half, dropping from about $200 to $100.

At the time, many gold investors sold out in disgust, never to return.

But then a funny thing occurred. Gold prices started to climb again, rising from $100 in mid-1976 all the way to $800 by January 1980.

And anyone who was fortunate enough to own gold at $35 earned better than 20 times their investment in just 12 years.

Twenty-one years later, a new bull market began. Since 2001, gold has consistently performed in what now appears to be a record-setting run.

In fact, since 2001 the average return on gold is now just shy of 18% annually over the last 11 years.

I know of no other major asset that has turned in this kind of performance -- ever. This rise in gold prices is simply unmatched.

This is what a stealth bull market looks like, one that I fully expect will keep powering on.

Now, let's have a look at where gold prices might be headed in 2013...

The remaining content is exclusively for Money Morning subscribers. To gain access, enter your email address:

During the last secular gold bull market in the 1970s, gold rose from $35 in 1968 all the way to $200 by late 1974.

Then the unthinkable happened. Between late 1974 and mid-1976, gold prices were cut in half, dropping from about $200 to $100.

At the time, many gold investors sold out in disgust, never to return.

But then a funny thing occurred. Gold prices started to climb again, rising from $100 in mid-1976 all the way to $800 by January 1980.

And anyone who was fortunate enough to own gold at $35 earned better than 20 times their investment in just 12 years.

Twenty-one years later, a new bull market began. Since 2001, gold has consistently performed in what now appears to be a record-setting run.

In fact, since 2001 the average return on gold is now just shy of 18% annually over the last 11 years.

I know of no other major asset that has turned in this kind of performance -- ever. This rise in gold prices is simply unmatched.

This is what a stealth bull market looks like, one that I fully expect will keep powering on.

Now, let's have a look at where gold prices might be headed in 2013...

The remaining content is exclusively for Money Morning subscribers. To gain access, enter your email address: